Economic Overview

Despite the proceeded with financial fixing and vulnerability in the worldwide economy, development is relied upon to be driven by the development segment, upheld by interests in huge foundation ventures, and a flexible administrations area, drove by discount and retail exchange development.

The legislature is reinforcing income organization and productivity through the presentation of electronic duty installments and modernizing the assessment assortment framework.

As of not long ago, development has been to a great extent reliant on common assets, and this has put expanding pressure on the earth. Ecological debasement is negatively affecting the nation due the consumption of regular assets and unfriendly effects on human wellbeing from contamination and waste. Perceiving the constraints of this development model, Lao PDR has executed changes to help greener, increasingly comprehensive development.

A cleaner and more asset effective development model in Lao PDR can likewise have a significant human effect: 70% of the Lao populace despite everything relies upon timberlands and conduits for money and nourishment, and better air quality will improve people’s health.

Main sectors of industry

Agriculture

Information demonstrates that about 4% of Laos’ complete territory, which is approximately 3,475 square miles, is utilized for horticulture albeit 19,305 square miles is viewed as arable land.

One of the essential harvests developed in Laos is rice which involved about 80% of the nation’s developed land from 1989 to 1990. Water system is principally used to supply water in the rice fields. The legislature endeavored to expand the land under water system to support the nation’s farming yield. Aside from expanding the land under water system, the legislature of Laos additionally encouraged ranchers to use ranch sources of info, for example, composts. Aside from rice, other significant yields developed in Laos incorporate espresso, opium, and corn. The individuals of Laos additionally keep creatures, for example, dairy cattle, goats, and pigs.

Mining

Mining is one of the fundamental enterprises in Laos and in 2012 it contributed 7% to the nation’s economy. Laos is viewed as one of Asia’s most asset rich countries because of the abundance of mineral assets in the nation, for example, lead, copper, and gold. Laos’ mineral riches has pulled in countless outside financial specialists from nations, for example, China and Australia.

The Phu Kham mine is additionally fundamental to the economy of Laos since it has stores of gold, copper, and silver. Laos additionally has immense stores of gypsum for the most part mined at the Ban laomakkha mine.

Textile Industry

The material business likewise assumes a huge job in the economy of Laos and in 2006 in excess of 30,000 occupants of Lao worked in the business. The material business in Laos developed exponentially from 1990 when just two organizations were managing materials to in excess of 110 organizations in 2006. The majority of the material items from Laos are sent out to countries in the European Union. The material business in Laos draws in huge quantities of remote financial specialists in spite of the fact that the administration shows that the lack of gifted laborers has disheartened greater interest in the segment.

Tourism

The travel industry is one of the most significant businesses in Laos and it procures the nation tremendous measures of remote trade. Information from the legislature shows that Laos’ travel industry becomes quicker than some other industry in the country.

Taxation in Laos

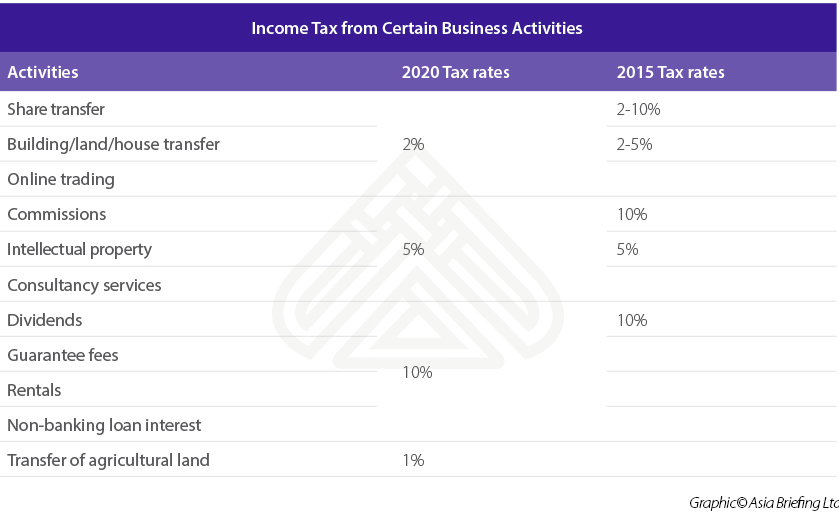

On February 17, 2020, Laos’ new Income TaxLaw (Tax Law No. 67/NA) come into effect. The law replaces Tax Law No. 70/NA, which was issued in 2015 and sets out the latest tax rates for businesses and employees.

The new Income Tax Law has brought down the benefit charge (PT) rate for little, medium, and large enterprises for most exercises and there will be two yearly documenting periods contrasted with four already. Moreover, the law gives better dynamic rates and a bigger finding base for individual personal expense (PIT).

PT is collected from all domestic and foreign businesses and is imposed on profits. The progressive rates range from 0-20 percent.

Investing in Laos

Lao PDR keeps on showing versatile, supportable and comprehensive monetary development, kicking the worldwide downturn and is well on its way towards moving on from Least Developed Country status by 2024.

Upheld by exceptional advancement over the most recent 20 years, Lao PDR is in prime situation to rise as a financial and vital speculation passage to the ASEAN showcase, to a great extent because of the eighth National Socio-Economic Development Plan (NSEDP) 2016-2020 managing arrangement needs across government to accomplish the nation’s monetary and improvement change targets.