Italy economic overview

Italy is the world’s ninth biggest economy. Its economic structure is mainly based on services and manufacturing. The services sector is three quarters of total GDP and this sector’s employs are about 65% of the country’s total employed people, then it’s the retail sales and transport sector.

Industry sector is a quarter of Italy’s total production. Manufacturing is the most important sub-sector within the industry sector. The country’s manufacturing is specialized in high-quality goods and is mainly run by small- and medium-sized enterprises, mostly family-owned ones. The other part of GDP is occupied by agriculture.

The country is divided into two parts:

- Highly-industrialized and developed northern part, where is produced 75% of the nation’s wealth

- Less-developed, more agriculture-depended southern part.

The long and deep recession of the Italian economy ended in 2015. The consensus macroeconomic forecasts point to a slight acceleration in GDP growth in 2016, which should reduce Italy’s growth gap vis-à-vis, the euro area. The Import of goods and services, especially for energy products, intermediate inputs and capital goods, led to a 6% grow.

The data show a slowdown in trade: the growth percentage of imports of goods and services compared with a year earlier fell to 1.2 percent. The growth of imports is relatively strong. Viewed in a longer-term perspective, the market shares of Italian exports have been stabilized in the past few years.

At current prices, Italy’s share of world exports has been equal to about 2.8 percent in the last three years. In particular, Italy’s share received a lift from the demand for personal care and household consumer goods, whose weight in world trade has increased in recent years, reversing a long decline, thanks to the expansion of the middle classes in the emerging countries.

Regions and main countries

The growth in Italy’s trade surplus in 2015 resulted from highly contrasting changes vis-à-vis the main regions. The balances with the Middle East, North Africa and Central Asia also improved considerably, thanks to the fall in the prices of imported energy commodities.

By contrast, the deficit with East Asia widened, particularly that with China, which grew from €15 billion to €18 billion as exports slumped unexpectedly by 0.7 percent. The surplus with the European Union also declined, falling from €15 billion to €11.5 billion as a consequence of negative developments in the balances with several countries, including Germany, Ireland and Poland, which more than offset the improvements in those with others, among them the United Kingdom and Spain.

Firms

The number of export-oriented firms continued to grow in 2015, reaching a new peak of over 214,000. The average amount of exports per firm also rose, approaching €1.9 million.

The growth in the number of exporting firms is fueled from below, in the smallest size class, by newcomers to foreign markets, responding to the need to find alternative outlets and also recently, by the opportunities created by the depreciation of the euro.

However, many of these new exporters fail to go beyond occasional sales and to consolidate their presence abroad. In the larger size classes the process of competitive selection proceeds, although there are recent signs of an upturn in the number of firms belonging to the largest size class, with export sales of more than €15 million.

Italy’s anomaly compared with the other main euro-area countries stands out most clearly in the case of large firms, which account for a much smaller share of both the number of exporting firms and the value of exports than in France, Germany or Spain.

At the opposite extreme, export-oriented micro-firms contribute a very modest share of the value of exports. Small and medium- sized enterprises play an important role instead, accounting for half of the value of Italian exports compared with barely a fifth of German exports and a quarter of those of France.

The increase in the Italian economy’s external openness is also reflected in the percentage of export-oriented firms among all active firms. Compared with companies that only do business on the domestic market, export-oriented firms are generally larger, have higher productivity and are more skilled-labor.

Exports, notably those of intermediate goods, can also help to strengthen firms’ innovative capacity and competitiveness.

The positive correlation between imports and productivity is most evident in the case of exporting firms, especially those that act as suppliers of inputs in international production networks.

Foreign Direct Investment

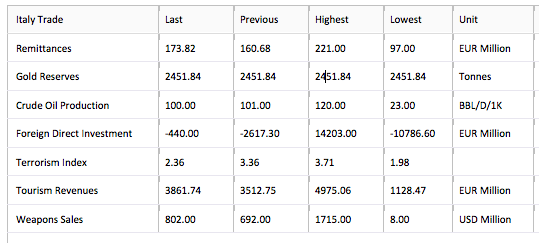

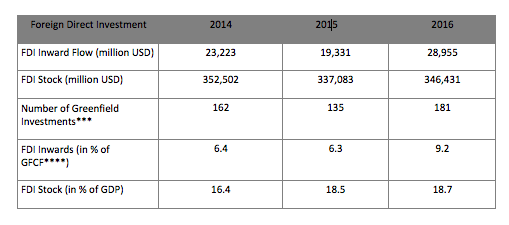

Foreign Direct Investment in Italy decreased by -440 EUR Million in April of 2017. Foreign Direct Investment in Italy averaged 1330.94 EUR Million from 1997 until 2017, reaching an all-time high of 14203 EUR Million in January of 2009 and a record low of -10786.60 EUR Million in May of 2009.

After a highly volatile period of investment flow, between 2008 and 2012, foreign direct investments (FDI) in Italy, have been stabilized and maintained a sustained pace. Investment flows reached USD 28.9 billion in 2016, making Italy the 15th recipient of FDI in the world, ahead of most major economies including France, Mexico, Spain and Japan.

Why You Should Choose to Invest in Italy

Strong Points

– Italian SMEs have demonstrated a great capacity for adaptation.

– Italy has a qualified workforce, with technical knowledge and experience in high-quality production.

– New regulations and programs initiated at the EU level are creating demand

– Italy hosts major trade shows that attract buyers from all parts of the world. The 2015 Milan expo drew in around 20 million visitors from across the globe.

– Italy is a geographic hub with a highly diversified export structure and strong manufacturing sector

– The reform-minded Government in 2015-16 created new opportunities in diverse sectors. The Italian Government has already started to withdraw from several sectors (including energy and telecommunications).

Weak Points

– Elevated procedural costs and slow administrative processes (although the process to start a business has been eased in the past couple of years).

– Corruption has taken a toll on investment and development.

– The infrastructure in some regions, especially in the south, is poor.

– Weak enforcement of intellectual property rights is still a problem.

– Italian labor costs are high and productivity has barely increased in the last fifteen years – a fact which is not fully explained by Italy’s specialization in low to medium value-added sectors.

– While the Government is seeking to boost investment in research and development, current spending on R&D remains low.

Government Measures to Motivate or Restrict FDI

The Government supports FDI via tax credits, including 25% for private investments in R&D (50% for projects with universities or research institutions) and 15% for investments in machinery and capital goods. Further public support is granted to new investments in manufacturing and R&D, especially in southern regions.

The 2015 Stability Law and ‘Investment Compact Decree’ provided the following:

- Patent box – partial tax exemption on income derived from patents, know-how and trademarks if R&D activities are performed by an Italian company

- Enhanced R&D tax credit

- Full deductibility from local tax of labor costs for employees hired on a permanent basis

- Extension of the tax incentives provided to technological start-ups and innovative SMEs

- Refinancing of prior tax credits/incentives for the purchase of industrial equipment

- Italy is a strategic point to reach 500 million consumers throughout the European Union and 270 million in North Africa and the Middle East, and is the main artery connecting southern Europe to Central and Eastern Europe.

- For more than 30 years, Italy is the 2nd largest production economy in Europe after Germany, and seventh in the ranking of the world’s leading manufacturers

- Italy is 5th among the G20 countries, due to surplus of commercial production, net of energy and mining production.

- Italy has sales leadership positions over 935 products of 5,117 total products marketed (the most detailed breakdown of world trade for the industry): It is 1st out of 235 products, 2nd out of 377 products and 3th on 323 products.

- Investing in Italy means gaining access to unique export know-how in important areas such as machinery and automation, fashion, design and food.

- More than 20 Italian universities are ranked in the top 500 academic institutions in the world, with about 300,000 graduates per year.

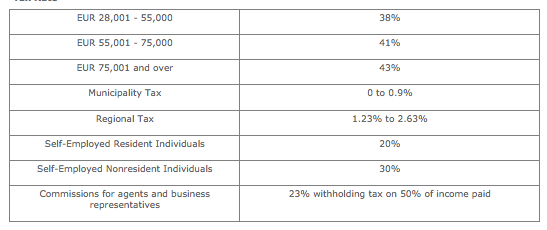

Tax Rate